2017 Tax Law Is Fundamentally Flawed

Por um escritor misterioso

Last updated 01 junho 2024

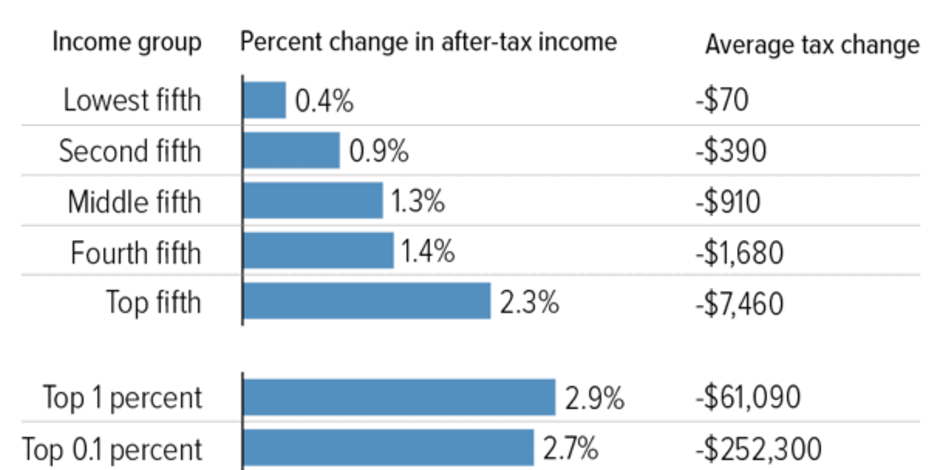

The major tax legislation enacted in December 2017 will cost about $1.9 trillion over ten years and deliver windfall gains to wealthy households and profitable corporations, further widening the gap

The Biden Tax Plan: How the Build Back Better Act Could Affect

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9892355/tpc4.png)

The Republican tax bill that could actually become law, explained

The Trump tax law has big problems. Here's one big reason why

Taxing the rich: The effect of tax reform and the COVID-19

Uber shifted scrutiny to drivers as it dodged tens of millions in

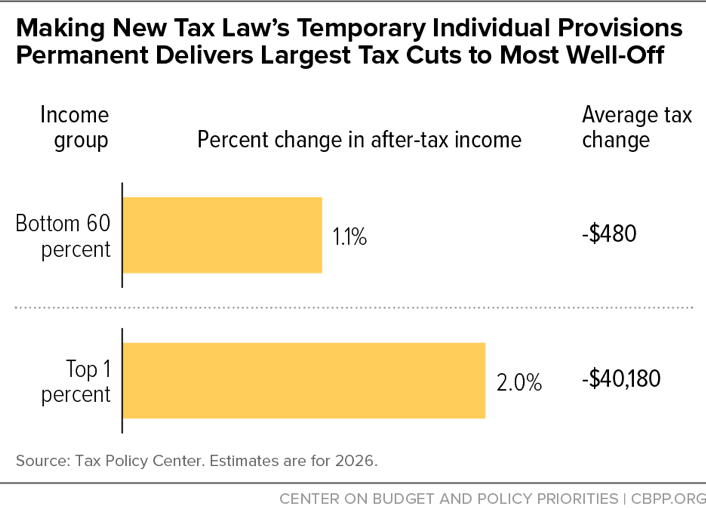

Unfinished Business From the 2017 Tax Law

How FedEx Cut Its Tax Bill to $0 - The New York Times

Wisconsin Real Estate Magazine: Fair and Accurate Assessments

Sales taxes in the United States - Wikipedia

10 Landlord-Tenant Laws to Remember

How did the Tax Cuts and Jobs Act change personal taxes?

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

What's Wrong With the American Tax System

Recomendado para você

-

Urban Dictionary Store01 junho 2024

Urban Dictionary Store01 junho 2024 -

qwertyuiopasdfghjklzxcvbnm01 junho 2024

qwertyuiopasdfghjklzxcvbnm01 junho 2024 -

1234567890qwertyuiopasdfghjklzxcvbnm mnbvcxzlkjhgfdsapoiuytrewq098765401 junho 2024

-

I got nothing. : r/memes01 junho 2024

I got nothing. : r/memes01 junho 2024 -

iFunny :)01 junho 2024

iFunny :)01 junho 2024 -

I believe in PC supremacy : r/memes01 junho 2024

I believe in PC supremacy : r/memes01 junho 2024 -

Steam Workshop::Zeh's Library of Dice01 junho 2024

-

Faster than light : r/trolllogic01 junho 2024

Faster than light : r/trolllogic01 junho 2024 -

Day 10 of 30 day challenge01 junho 2024

Day 10 of 30 day challenge01 junho 2024 -

Fakers 21, PDF, Text01 junho 2024

você pode gostar

-

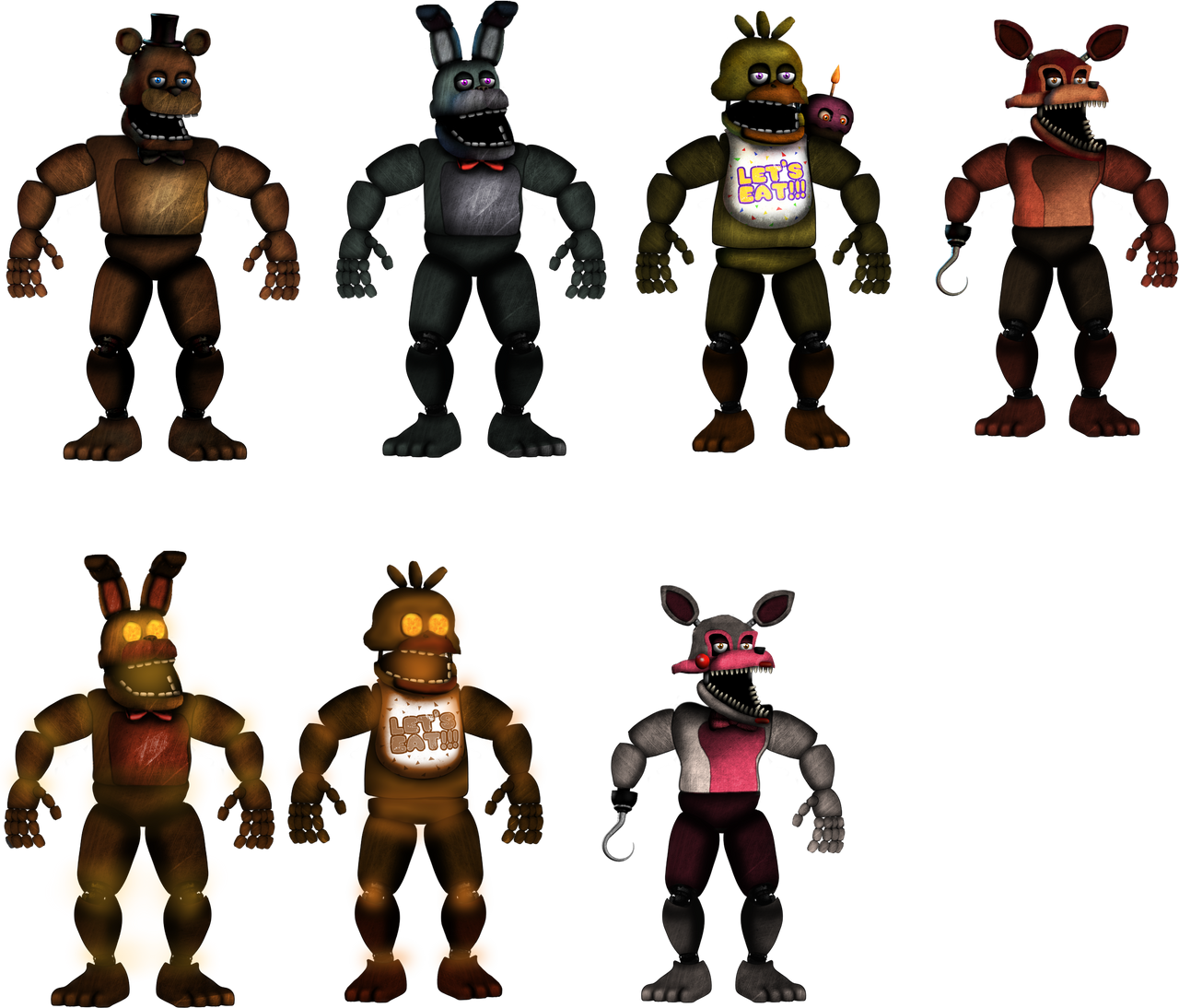

Fixed FNaF 4 animatronics by FreddyTheMedved on DeviantArt01 junho 2024

Fixed FNaF 4 animatronics by FreddyTheMedved on DeviantArt01 junho 2024 -

In the Land of Leadale vai ter 12 episódios01 junho 2024

In the Land of Leadale vai ter 12 episódios01 junho 2024 -

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2021/V/m/EdoEdRTgy1BjmunWxxvg/2016-08-01-pulo3d.gif) Como criar um GIF 3D01 junho 2024

Como criar um GIF 3D01 junho 2024 -

/i.s3.glbimg.com/v1/AUTH_19863d4200d245c3a2ff5b383f548bb6/internal_photos/bs/2022/J/B/6sB969T7WA2UPE2sWSiw/barriga-de-gravida-zero.jpg) Mãe mostra que sua barriga de grávida só apareceu duas semanas antes do parto01 junho 2024

Mãe mostra que sua barriga de grávida só apareceu duas semanas antes do parto01 junho 2024 -

Fairy Tail: Final Series01 junho 2024

Fairy Tail: Final Series01 junho 2024 -

Assistir Dies Irae Todos os Episódios Online01 junho 2024

Assistir Dies Irae Todos os Episódios Online01 junho 2024 -

![Catwoman(AK Face Texture) [Batman: Arkham City] [Mods]](https://images.gamebanana.com/img/ss/mods/6231932d703f1.jpg) Catwoman(AK Face Texture) [Batman: Arkham City] [Mods]01 junho 2024

Catwoman(AK Face Texture) [Batman: Arkham City] [Mods]01 junho 2024 -

What am I doing wrong? : r/Mahjong01 junho 2024

What am I doing wrong? : r/Mahjong01 junho 2024 -

App The Man from the Window Game Android game 202201 junho 2024

-

Stream Shokugeki no Soma, Spice, (Old Cover) by rinM01 junho 2024

Stream Shokugeki no Soma, Spice, (Old Cover) by rinM01 junho 2024