Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

Por um escritor misterioso

Last updated 18 junho 2024

:max_bytes(150000):strip_icc()/debtequityratio_final-86f5e125b5a3459db4c19855481f4fc6.png)

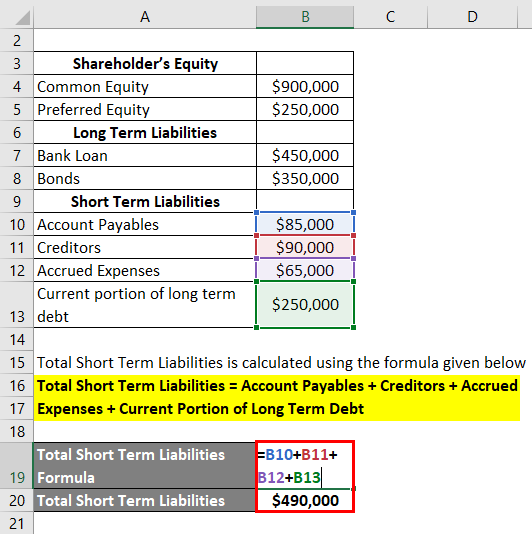

The debt-to-equity (D/E) ratio indicates how much debt a company is using to finance its assets relative to the value of shareholders’ equity.

Summary of Debt to Equity Ratio. Abstract

Debt to Equity Ratio Explained

A Guide to the Gearing Ratio: What is it and how to Calculate

Interpretation of Debt to Equity Ratio

How to Analyze Debt to Equity Ratio: 7 Steps (with Pictures)

How to find debt-to-equity ratio

Debt to Equity Ratio (D/E Ratio) - Detailed Explanation with Example - Yadnya Investment Academy

:max_bytes(150000):strip_icc()/Gearing_Final-880660361a544f1e99cb349d2d8054f4.png)

What Is Gearing? Definition, How's It's Measured, and Example

The Debt-to-equity Ratio Formula

Risk Analysis: The Debt-to-Equity Ratio

:max_bytes(150000):strip_icc()/debtequityratio_final-86f5e125b5a3459db4c19855481f4fc6.png)

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

Recomendado para você

-

Get over it – Volare Chit Chat 27 Oct 2016 – dinie hz18 junho 2024

Get over it – Volare Chit Chat 27 Oct 2016 – dinie hz18 junho 2024 -

O que significa it's over em inglês? - inFlux18 junho 2024

O que significa it's over em inglês? - inFlux18 junho 2024 -

Man Up O que significa este phrasal verb? - Mairo Vergara18 junho 2024

Man Up O que significa este phrasal verb? - Mairo Vergara18 junho 2024 -

:max_bytes(150000):strip_icc()/Investopedia_StimulusCheck-70459e6dcc644ec28a518b746239f62f.jpg) What Is a Stimulus Check? Definition, How It Works, and Criticism18 junho 2024

What Is a Stimulus Check? Definition, How It Works, and Criticism18 junho 2024 -

What Does Lit Mean, Slang Definition of Lit18 junho 2024

What Does Lit Mean, Slang Definition of Lit18 junho 2024 -

Aragonite Crystal Meaning Crystals, Crystals healing properties, Spiritual crystals18 junho 2024

Aragonite Crystal Meaning Crystals, Crystals healing properties, Spiritual crystals18 junho 2024 -

Used to: o que significa e como usar essa estrutura18 junho 2024

Used to: o que significa e como usar essa estrutura18 junho 2024 -

Verbos frasais em inglês Linguagem informal, Verbos, Expressões idiomáticas18 junho 2024

Verbos frasais em inglês Linguagem informal, Verbos, Expressões idiomáticas18 junho 2024 -

Killing the Black Body: Race, by Roberts, Dorothy18 junho 2024

Killing the Black Body: Race, by Roberts, Dorothy18 junho 2024 -

Manakah yang benar, 'get over it' atau 'get over with'? - Quora18 junho 2024

você pode gostar

-

Ghost B.C. - Secular Haze18 junho 2024

Ghost B.C. - Secular Haze18 junho 2024 -

Volante Simlador Logitech G27 Racing Wheel Force Pc Ps318 junho 2024

Volante Simlador Logitech G27 Racing Wheel Force Pc Ps318 junho 2024 -

Mini Bola de Basquete Baby - Lojão dos Esportes18 junho 2024

Mini Bola de Basquete Baby - Lojão dos Esportes18 junho 2024 -

predictors · GitHub Topics · GitHub18 junho 2024

-

Fuuto Tantei18 junho 2024

Fuuto Tantei18 junho 2024 -

Create a All star tower defense 7 star rankings! Tier List - TierMaker18 junho 2024

Create a All star tower defense 7 star rankings! Tier List - TierMaker18 junho 2024 -

Pin by Ele na on made in abyss in 202318 junho 2024

Pin by Ele na on made in abyss in 202318 junho 2024 -

Chloë Moretz Height - How tall18 junho 2024

Chloë Moretz Height - How tall18 junho 2024 -

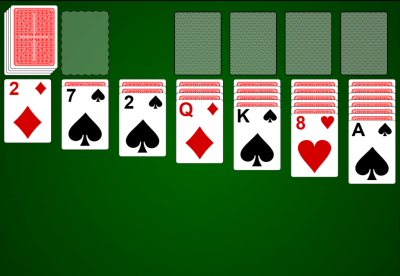

RikkiGames - 3 Draw Klondike Rules18 junho 2024

RikkiGames - 3 Draw Klondike Rules18 junho 2024 -

FRUTA DO LUFFY VS FRUTA DO KATAKURI NO BLOX FRUITS !! ‹ BREN0RJ18 junho 2024

FRUTA DO LUFFY VS FRUTA DO KATAKURI NO BLOX FRUITS !! ‹ BREN0RJ18 junho 2024