or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Last updated 02 junho 2024

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

Thoughts? I'll probably deactivate my listings 12/31/21. Not about to pay taxes on stuff I've already paid taxes on. Especially when it's just stuff I'm just trying to get rid off and

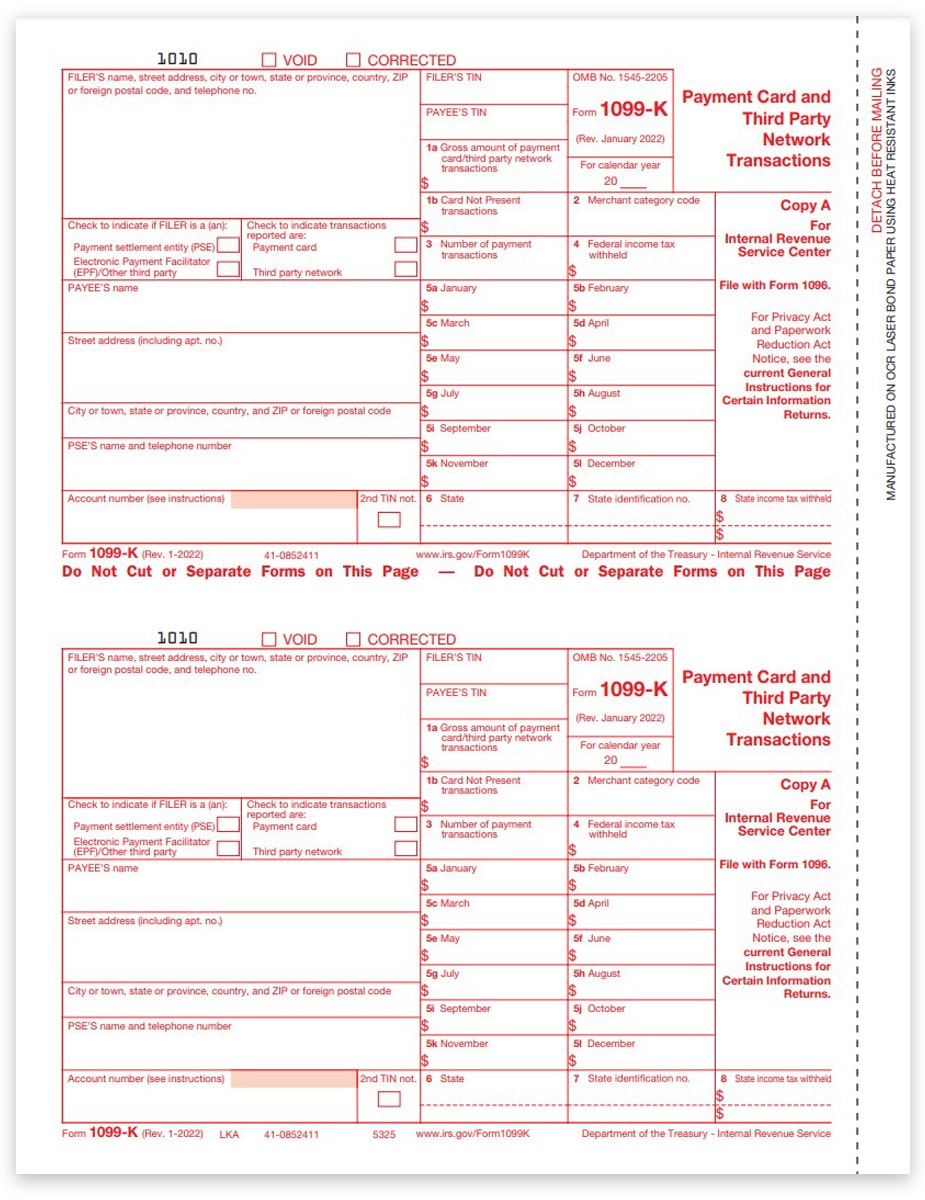

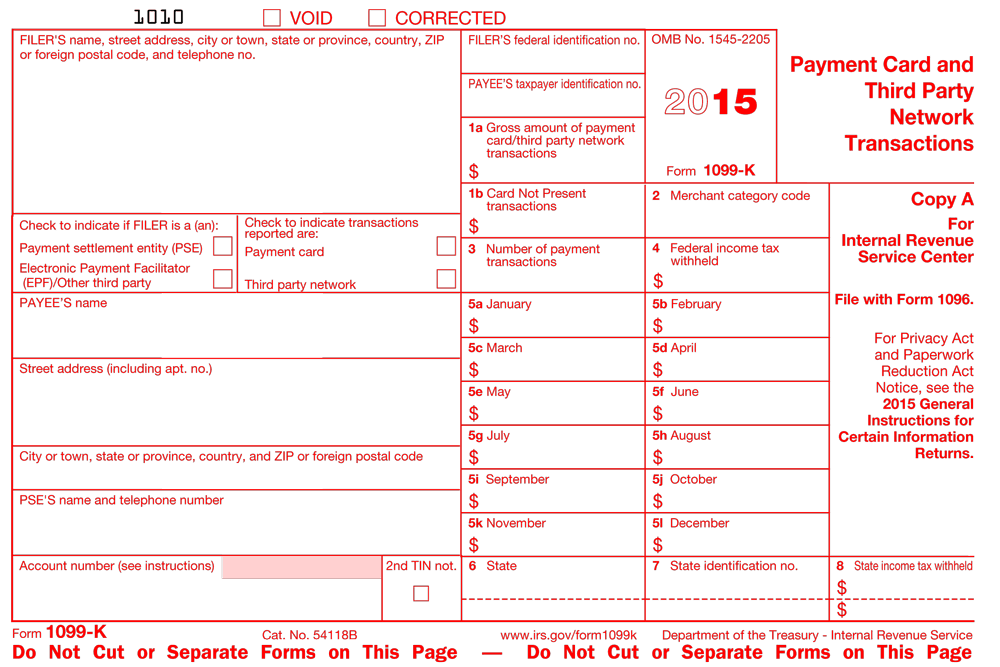

Official 1099K Tax Forms, Use 1099K Copy A forms to report payment cards and third-party network transactions to the IRS., Order as few as 25 forms

1099-K Form - Copy A Federal

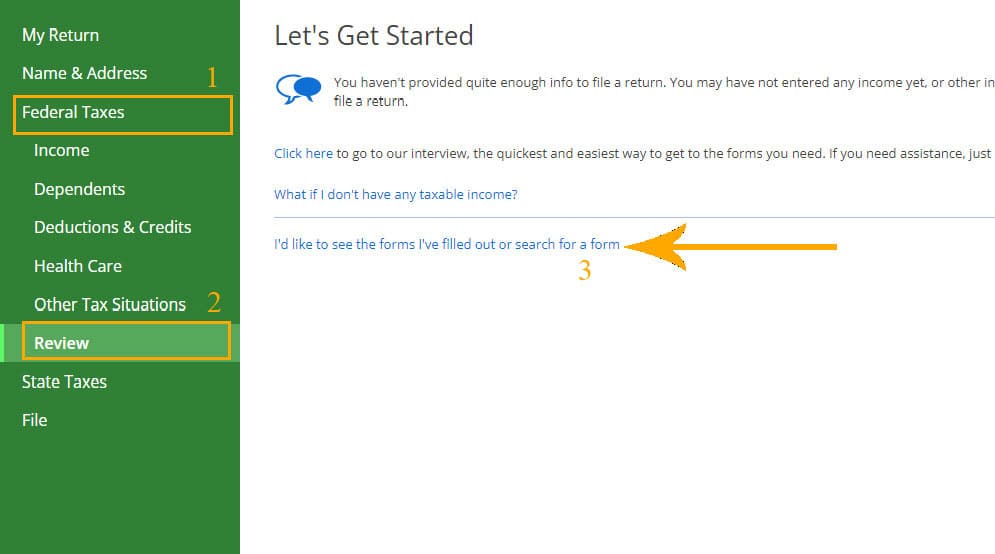

How to Report Income on a 1099 Form -Simple Instructions

Form 1099-K - IRS Tax Changes and Business Accounts

New tax rule on apps like Venmo, PayPal could spell confusion for small businesses - CBS News

Jobber Payments and 1099-K – Jobber Help Center

IRS will delay $600 1099-K reporting for a year - Don't Mess With Taxes

What is a 1099-K, How Does It Affect My Business? - VMS

Corpus Christi business owners could have complicated tax season

1099 c 2008

new 600 dollar SALES threshold for IRS Reporting , - The Community

Recomendado para você

-

eGift Card02 junho 2024

-

Projects Better Revenue For Current Quarter Than Expected02 junho 2024

Projects Better Revenue For Current Quarter Than Expected02 junho 2024 -

Wikipedia02 junho 2024

Wikipedia02 junho 2024 -

s Management of Payments Begins Scaling Globally02 junho 2024

s Management of Payments Begins Scaling Globally02 junho 2024 -

beats in m-commerce - E-commerce Germany News02 junho 2024

beats in m-commerce - E-commerce Germany News02 junho 2024 -

Slides After Disappointing Forecast for Holiday Sales02 junho 2024

-

A History of : Facts and Timeline - TheStreet02 junho 2024

A History of : Facts and Timeline - TheStreet02 junho 2024 -

How to Get More Views on : Tips for 202402 junho 2024

How to Get More Views on : Tips for 202402 junho 2024 -

—02 junho 2024

—02 junho 2024 -

vs : Best marketplace in 202302 junho 2024

vs : Best marketplace in 202302 junho 2024

você pode gostar

-

Campeonato Paulista Sub-20 Archives - Santos Futebol Clube02 junho 2024

Campeonato Paulista Sub-20 Archives - Santos Futebol Clube02 junho 2024 -

Wizard News: Mardi Gras, Fat Tuesday, Carnival and Carnaval02 junho 2024

Wizard News: Mardi Gras, Fat Tuesday, Carnival and Carnaval02 junho 2024 -

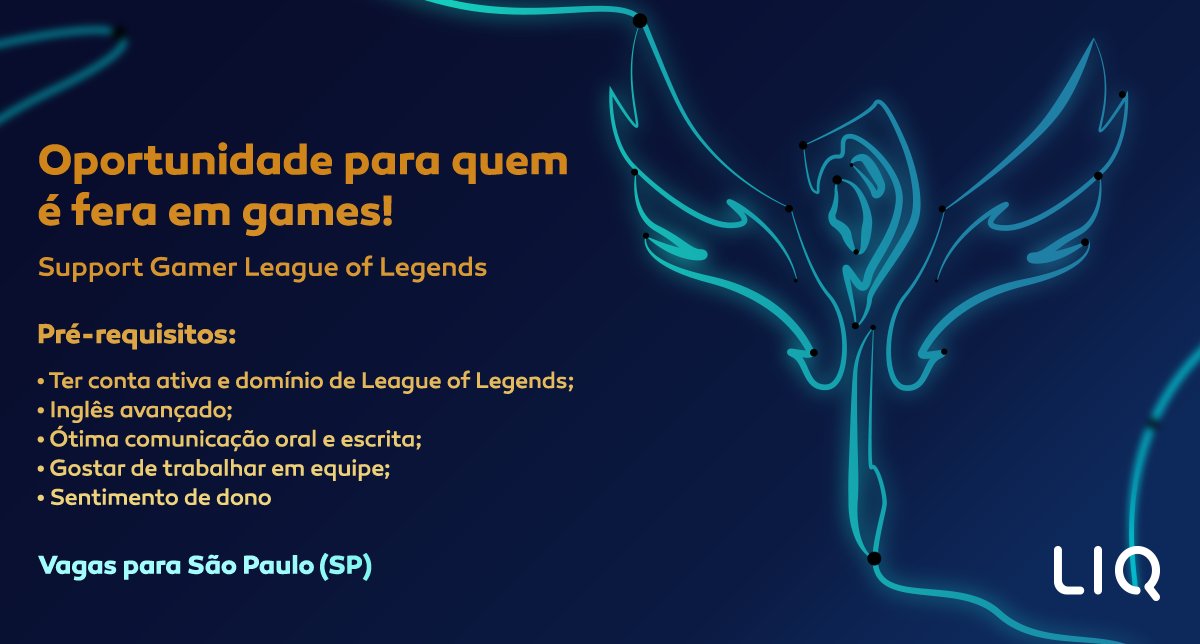

Liq (@LiqOficial) / X02 junho 2024

Liq (@LiqOficial) / X02 junho 2024 -

Flamengo se prepara para 'maratona' de decisões em outubro - Coluna do Fla02 junho 2024

Flamengo se prepara para 'maratona' de decisões em outubro - Coluna do Fla02 junho 2024 -

The Last Of Us Part 2, Face Models, Dina, Nora, Ellie, Abby, Joel, Yara, Lev, Emily02 junho 2024

The Last Of Us Part 2, Face Models, Dina, Nora, Ellie, Abby, Joel, Yara, Lev, Emily02 junho 2024 -

Community Forums: Known Issue: Map blank/white in bottom-left of screen02 junho 2024

-

My Mini Mart APK + Mod 1.18.36 - Download Free for Android02 junho 2024

My Mini Mart APK + Mod 1.18.36 - Download Free for Android02 junho 2024 -

Virgin roblox kid vs chad no face slender man - Imgflip02 junho 2024

Virgin roblox kid vs chad no face slender man - Imgflip02 junho 2024 -

Tears in Heaven (2021) - DramaPanda02 junho 2024

Tears in Heaven (2021) - DramaPanda02 junho 2024 -

The Elder Scrolls Online Summerset - Cinematic Trailer - 602 junho 2024

The Elder Scrolls Online Summerset - Cinematic Trailer - 602 junho 2024